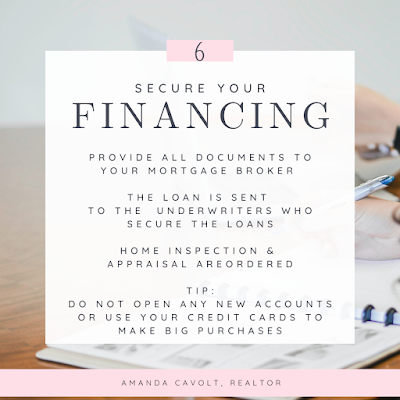

Buy Your First Home in 8 Steps: Step 6

A Guide for First-Time Homebuyers

Buying a home is the biggest investment you will make in your life. It can be stressful, overwhelming, emotional and exhausting. I believe with the right tools and education; you will feel confident and empowered to pursue your Real Estate dreams.

As a Realtor®, I am committed to helping first-time homebuyers confidently navigate the homebuying process.

Underwriting is where the lender assesses the risk of lending you the money. The lender will call to verify your employment and ask you for more financial documents. Underwriters will dive deeper into your credit history, performing a debt-to-income ratio with your assets and debts. They will review the property details ultimately giving the final approval on the loan.

A Word of Caution

Please, talk with your loan officer before making any big financial decisions or changes.It may effect your loan and your ability to buy your home.

For Example: Using credit cards, Opening/Closing new accounts, or changing banks.

A Change in jobs or a change in your work schedule will also effect your ability to purchase a home.

What Happens Next?

Another part of securing the financing on your loan is the Inspection & Appraisal processes.

These are contingencies and must happen within a specified time frame. More on this topic in Step 7.

Comments

Post a Comment

Join the conversation by leaving a comment!